Sbi Simply Click Credit Card Referral Code (2tVYyBSDegB)

Do you want to receive ₹500 of gift card by just sign up for the SBI credit card.

If yes then you are the right place.

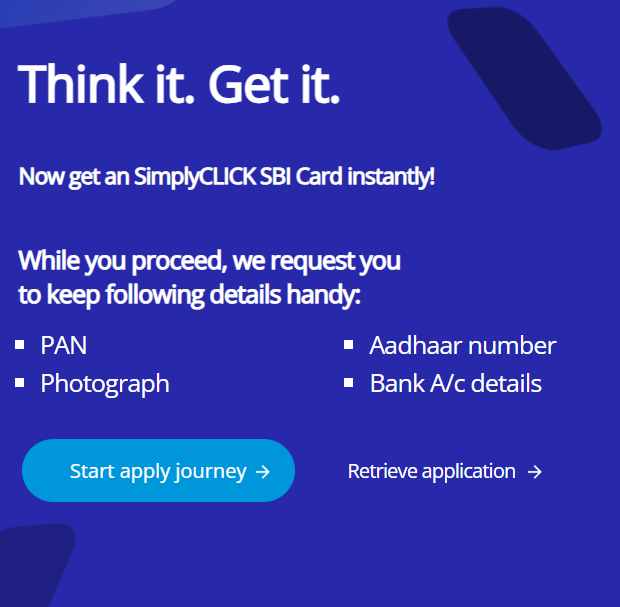

SBI simply click credit card is one of the best cards that you can apply. You can you can apply for the card with the referral code 2tVYyBSDegB.

By using the referral code (2tVYyBSDegB) I have provided in this article you can get 500 Amazon pay balance by using the gift card.

This is because of SBI card refer and earn program rewards both referee and the referrer.

if you share your referral code with your friends and family and if they get a card with your referral code you will get the benefits.

You will receive gift card of ₹500 that can be used to purchase anything from Amazon.

Benefits

- ₹500 Gift Voucher: you receive a gift voucher worth ₹500 once you make your first payment.

- Exclusive Benefits: The referee receives offer benefits when making their first payment.

- Validity: These benefits are valid for up to 90 days from the account opening date.

Sbi Simply Click Credit Card Benefits

Sbi simply clicks credit card offers several benefits. I am using this card for several years, and I am facing no complaint with it. Whenever I redeem my 2500 rewards points I get a 500 Amazon pay balance, which is very useful you can buy anything you want from Amazon. It also gives you offer to receive makemytrip balance or other partner balance.

SBI’s simply click credit card gives you immense reward points. If you spend ₹100 on its partner websites like Amazon, Make My Trip, Apollo 24*7, BookMyShow, Clear Trip, Domino’s, Myntra, Needs, Swiggy, and Yatra, you will get 10 reward points.

You will also receive 5 rewards point for every 100 spends if you spends on other side on online platform.

That’s quite good. You can enjoy these benefits and redeem your rewards point for further online shopping.

1. What are the benefits of the SBI SimplyCLICK Credit Card?

SBI simply click credit card gives you following benefits-

- 10X Reward Points: you get 10 X reward points with its partner merchant like Apollo 24×7, BookMyShow, Cleartrip, Domino’s, Myntra, Netmeds, Swiggy, and Yatra.

- 5X Reward Points: you can receive 5X reward points on all other online expense except fuel, wallet loading, and utility payments.

- Welcome Benefits: joining fee will be waived out because as soon as you join and make your first payment SBI credit card will give you ₹500 Amazon pay gift card. This amount can be used for online shopping on Amazon.

- Milestone Rewards: if you spend 1,00,000 and more in a year then you will receive a clear trip voucher of ₹2000.

- Fuel Surcharge Waiver: 1% waiver on fuel transactions between ₹500 and ₹3,000.

2. Does the SBI SimplyCLICK Credit Card offer lounge access?

No, the SBI SimplyCLICK Credit Card does not offer lounge access. It primarily focuses on online shopping benefits and reward points.

4. Is there a PDF available for the SBI SimplyCLICK Credit Card benefits?

Yes, download the official PDF of the SBI simply click credit card benefits from the given link. You just have to click on the link and you will be redirected to download the PDF.

5. What is the credit limit of the SimplyCLICK SBI Credit Card?

The credit limit of the SBI simply click credit card varies person to person. It depends upon the income, credit score, and repayment history of individual. SBI card decide the limit for SBI simply click credit card. If you have a good credit score with decent income and have a good repayment history then your credit card limit will be much more higher than an average income person

6. Is the SBI SimplyCLICK Credit Card available as a RuPay card?

Yes, the SBI SimplyCLICK Credit Card is available on the RuPay platform, offering added benefits like domestic merchant discounts and secure transactions.

7. What are the charges for the SBI SimplyCLICK Credit Card?

- Joining Fee: ₹499 plus applicable taxes.

- Renewal Fee: ₹499 (waived if annual spends exceed ₹1 lakh).

- Interest Charges: Up to 3.50% per month (42% annually).

- Late Payment Fee: ₹400 to ₹1,300, depending on the amount due.

8. What is the eligibility for the SBI SimplyCLICK Credit Card?

To be eligible, you must meet these criteria:

Documents Required: Identity proof, address proof, PAN card, and proof of income.

Age: 21–60 years.

Income: Stable income from employment or self-employment.

Credit Score: A good credit score with no defaults.

Key Benefits of Simply CLICK SBI Card

- Welcome Gift

- Receive a ₹500 Amazon.in gift card when you pay the annual fee of ₹499 + taxes.

- e-Shopping Rewards

- 10X Reward Points on online spending with selected partners: Apollo 24×7, BookMyShow, Cleartrip, Domino’s, Myntra, Netmeds, Swiggy, and Yatra.

- 5X Reward Points on all other online transactions.

- Milestone Rewards

- Enjoy e-vouchers worth ₹2,000 each from Cleartrip or Yatra when you reach annual online spending targets of ₹1 lakh and ₹2 lakh, respectively.

- Fuel Freedom

- Get a 1% fuel surcharge waiver on fuel transactions ranging from ₹500 to ₹3,000. This can make routine fuel expenses a little lighter on your wallet.

- Annual Fee Waiver

- Spend ₹1,00,000 or more in a year, and your next year’s annual fee of ₹499 is reversed.

- Contactless Technology

- Make quick, safe transactions by simply waving your card over a secured reader. This feature makes payment very easy, but keep in mind that you have to keep your card very safely, because anyone with your card have access to pay or use your cards for payments.

LOVE T READ-Amazon Coupon Code For Smart Watches | Smart Watch Coupon Code 2024

What is Flexipay, and how can I use it?

Flexipay allows you to convert any transaction above ₹2,500 into monthly installments.

What is the welcome gift with this card?

New cardholders receive a ₹500 Amazon.in gift card after paying the annual fee

How do the reward points work?

SBI simply click credit card gives you immense reward points benefit. If you spend ₹100 on its partner websites like Amazon, make my trip, Apollo 24*7, BookMyShow, clear trip, Domino’s, Myntra, netmeds, swiggy, and yatra.

What is the annual fee for the SimplyCLICK SBI Card?

The annual fee for the SimplyCLICK SBI Card is ₹499 plus applicable taxes.

Is there a fuel surcharge waiver?

Yes, a 1% fuel surcharge waiver is available for transactions between ₹500 and ₹3,000.

Can I get additional cards for family members?

Yes, add-on cards can be issued for immediate family members, including parents, spouse, children, or siblings over 18 years of age.

What is Flexipay, and how can I use it?

Flexipay allows you to convert any transaction above ₹2,500 into monthly installments.

No Comments

Leave Comment